Anúncios

A new way to bank without hidden costs

The TymeBank Debit Card gives South Africans free everyday banking with no monthly fees and an account you can open in just five minutes.

It offers digital control, instant transfers, savings with interest up to 10% annually, and a free Visa card accepted both nationwide and globally.

Debit Card

TymeBank

| Feature | Details |

| Monthly account fee | R0 |

| Visa Debit Card | Free initial card |

| Savings rate | Up to 10% with GoalSave |

| Transfers | PayShap instant payments (up to R5,000) |

| Cash withdrawals | Over 15,000 till points & ATMs |

TymeBank Debit Card: What you need to know

The TymeBank Debit Card links directly to the EveryDay account, which is opened online for free, with the physical card collected at kiosks in major retailers like Pick n Pay or Boxer.

Once activated, you can use the card online or in-store, making purchases with Visa’s global acceptance. It’s practical for both local and international shopping.

The account allows deposits and withdrawals at thousands of retail tills, including smaller spaza shops, with low or no fees when using recommended free channels.

A powerful GoalSave feature enables customers to earn competitive interest of up to 10% annually, making it more than just a spending tool but also a savings ally.

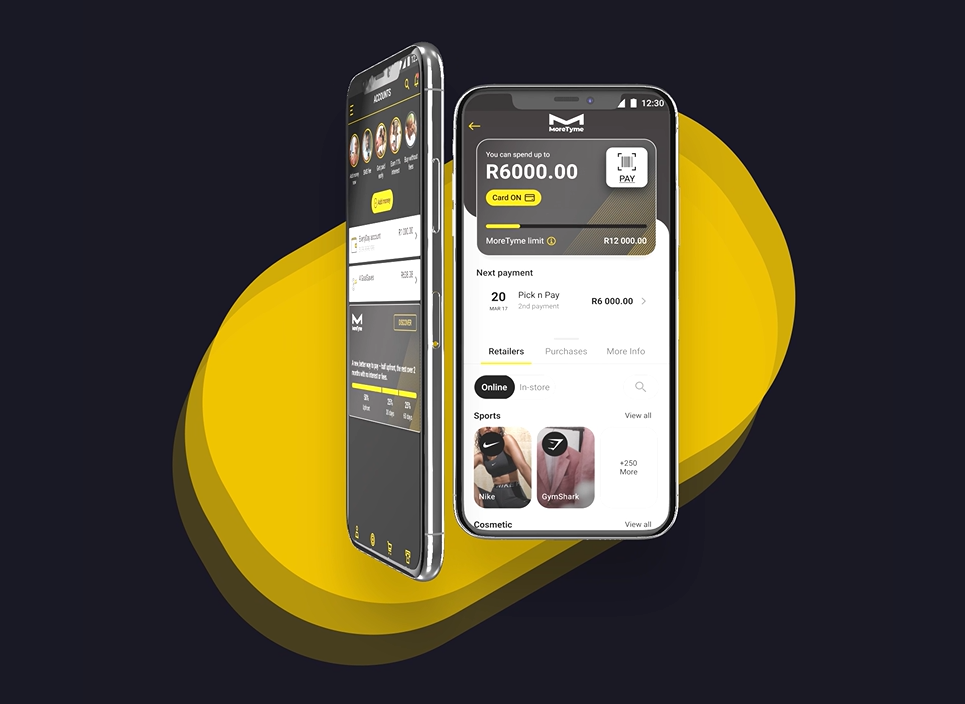

With MoreTyme, customers enjoy buy-now-pay-later flexibility, splitting payments into three instalments without interest, offering freedom without the traditional delays of lay-by shopping.

Debit Card

TymeBank

Who can benefit from this option?

The TymeBank Debit Card suits different types of South Africans who want simple, low-cost, and reliable banking. It’s not limited by age or income level.

- First-time account holders: Those opening their very first bank account benefit from zero monthly charges and a straightforward digital setup.

- Young professionals: People who want mobile-first banking, online payments, and simple budgeting tools find GoalSave and PayShap especially attractive.

- Families on a budget: Households needing to control expenses appreciate the zero monthly fee and free everyday transactions that prevent unnecessary costs.

- Small business owners: Informal traders and entrepreneurs value the ability to deposit and withdraw cash easily at tills and spaza shops.

- Shoppers seeking flexibility: Customers who prefer splitting purchases love MoreTyme, as it allows buy-now-pay-later shopping without paying interest.

What makes TymeBank Debit Card different?

In a crowded banking market, TymeBank distinguishes itself with innovation, affordability, and accessibility. This card represents more than just payments — it’s a holistic solution.

- Zero monthly charges: Unlike many competitors, TymeBank charges no fixed account fee, helping customers save money just by maintaining an account.

- Accessible everywhere: From large retailers to local spaza shops, you can manage deposits, withdrawals, and transactions across over 15,000 partner locations nationwide.

- High-yield savings: GoalSave offers up to 10% interest, which is exceptional in the South African banking landscape, turning an everyday account into a savings powerhouse.

- Smart shopping options: With MoreTyme, customers avoid interest and delays, splitting purchases into three simple instalments, making everyday shopping more flexible.

- Strong digital presence: The app and online banking tools provide real-time notifications, free statements, and easy access to account information.

Can you trust TymeBank?

Trust is vital when selecting a bank, and TymeBank is fully licensed by the South African Reserve Bank, operating under strict national financial regulations.

Security is prioritised through biometric verification such as face and fingerprint recognition, ensuring customers can safely access their accounts both in-app and at kiosks.

Transactions are double-checked with one-time passwords (OTPs), adding an extra layer of security against fraud and unauthorised access. Customers receive alerts for full transparency.

TymeBank also provides ongoing security tips and education to clients, empowering them to recognise risks. Combined with cutting-edge systems, this creates a safe, trustworthy environment.

Common uses of TymeBank Debit Card in practice

The TymeBank Debit Card is more than just a way to pay. It’s designed to meet everyday South African financial needs with efficiency and flexibility.

- Daily shopping: Pay securely in supermarkets, clothing retailers, or spaza shops without worrying about hidden monthly costs.

- Online purchases: The Visa Debit Card enables fast and reliable payments for e-commerce, streaming subscriptions, and digital services.

- Instant transfers: Send money instantly through PayShap, perfect for splitting bills, helping family, or managing group payments.

- Cash management: Deposit or withdraw funds easily at till points in over 15,000 stores, avoiding traditional bank queues.

- Flexible spending: Use MoreTyme to split payments into instalments, giving financial breathing space without paying interest.

Simple steps to get your TymeBank Debit Card

Applying for the TymeBank Debit Card is quick, transparent, and accessible. With a digital-first approach, most customers can open an account online in just minutes.

After opening the account digitally, you can collect your physical card at a TymeBank kiosk in selected Pick n Pay, Boxer, or TFG stores.

- Register online: Sign up on the TymeBank website or mobile app to create your EveryDay account quickly and securely.

- Provide your details: Enter your South African ID number and personal information for verification.

- Biometric verification: Confirm your identity with fingerprints or facial recognition for added security.

- Receive your card: Collect your free Visa debit card instantly at a TymeBank kiosk in participating Pick n Pay, Boxer, or TFG stores.

- Activate and use: Link it through the app, set up your PIN, and start banking right away.

Minimum conditions to get approved

To open a TymeBank EveryDay account and receive a debit card, applicants must be South African residents with a valid green barcoded ID or Smart ID card.

You need to be at least 16 years old, and the account should be registered in your name. There are no strict income requirements.

Since this is a debit card, there’s no credit check or affordability assessment. However, you must provide accurate personal details and verify your identity biometrically.

This makes TymeBank one of the most inclusive financial options available, granting access to millions of South Africans who previously struggled to obtain banking services.

Recommended alternative: Capitec Credit Card

The TymeBank Debit Card is excellent for everyday banking, free transactions, and savings. However, it remains a debit product, without extended credit facilities or loyalty rewards.

For customers seeking additional flexibility, credit limits, and travel perks, the Capitec Credit Card is a recommended alternative. It offers competitive rates, purchase protection, and international acceptance.

If you want to compare options, explore the Capitec Credit Card. It may complement TymeBank by covering needs that go beyond debit and savings. Discover more in our next article.

Recommended Content