Struggling to handle unexpected expenses or urgent needs?

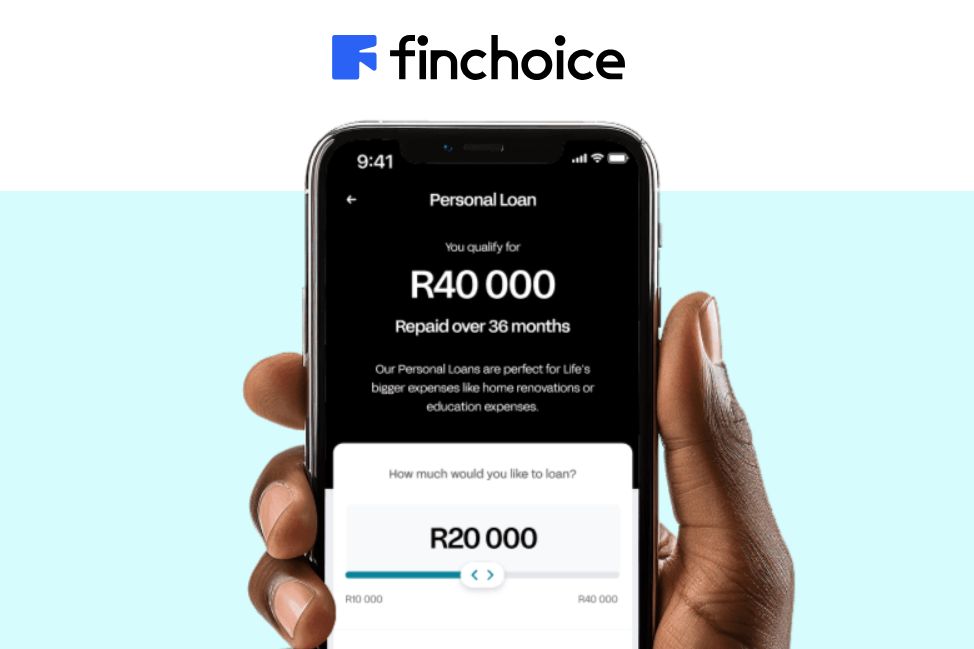

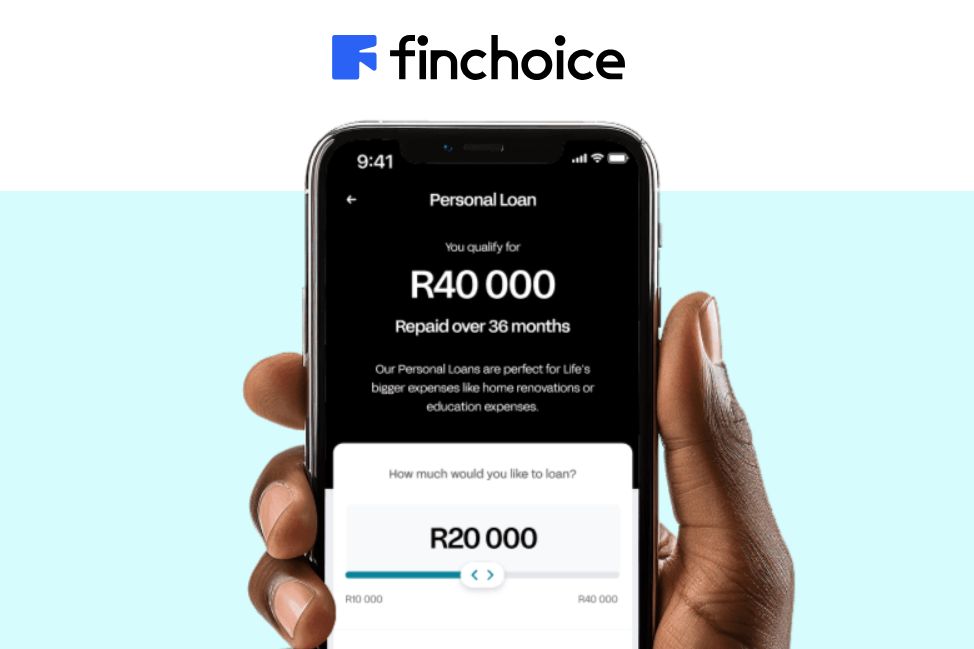

FinChoice Personal Loans offer fast approval and flexible terms — get up to R25,000 in just 24 hours.

Anúncios

Getting a personal loan doesn’t have to be complicated or stressful.

FinChoice has created a simplified process to help South Africans get financial relief quickly, entirely online.

With flexible repayment periods and personalized loan amounts, this loan is tailored for those who value time, efficiency, and control over their finances.

Next, we’ll look at the specific advantages and limitations so you can decide if this loan fits your financial needs.

Top Benefits You Can Count On

FinChoice Personal Loans are designed for convenience and flexibility, making them ideal for employed individuals needing access to quick funds without lengthy paperwork.

These loans work particularly well for people who need short-to-mid-term credit with easy application steps and fast disbursement. Here’s a breakdown of what makes FinChoice stand out:

- Quick and Simple Application:

Apply entirely online in just a few minutes — no paperwork or branch visits required. The 24/7 process saves time and is user-friendly for everyone. - Fast Payout Within 24 Hours:

Once your documents are received and verified, the approved loan amount is transferred to your bank account within 24 hours — ideal for urgent financial needs. - Flexible Loan Terms:

You can choose to repay your loan over 6, 12, or 24 months, allowing you to tailor monthly instalments to suit your personal budget and income. - Skip a Payment Feature:

In financially tight months, FinChoice gives you the flexibility to skip one payment without extra charges — a useful option for dealing with unexpected expenses. - No-Risk 14-Day Return Policy:

If you change your mind, you can return the full loan amount within 14 days of receiving it, with no interest, penalties, or fees applied.

Loan Drawbacks You Shouldn’t Ignore

Even with several strengths, FinChoice Personal Loans have limitations that should be evaluated before making a decision.

These potential downsides are important to consider if you’re comparing different personal loan options on the market:

- Not Available for Everyone:

Only existing FinChoice customers or individuals who receive a direct marketing invitation are eligible, which limits access for first-time applicants without prior relationship. - Limited Loan Amount:

With a maximum loan limit of R25,000, the product may not meet the needs of clients looking for higher-value financing for larger expenses or investments. - Strict Document Requirements:

You must upload valid identification, proof of income, and banking details before loan disbursement, which adds extra steps compared to more simplified lending services. - DebiCheck Required:

Borrowers must authorize a DebiCheck mandate for monthly repayments. While secure, this may not appeal to users unfamiliar with digital debit authorization systems.

It’s essential to review these points carefully. While FinChoice offers many perks, understanding the full scope of the terms can help you make a well-informed decision.

Smart Tips for a Safe Loan Application

To get the most out of FinChoice Personal Loans while staying financially secure, follow these tips:

- Check Loan Terms Thoroughly:

Always read the full loan agreement, including interest rates and fees. - Prepare All Documents Early:

Have your ID, proof of income, and bank details ready for a smooth process. - Monitor Your Bank Account:

Ensure DebiCheck payments are deducted correctly each month. - Avoid Overborrowing:

Only borrow what you truly need and can comfortably repay.

Final Thoughts – Why FinChoice Personal Loans Are Worth Considering

FinChoice Personal Loans offer a fast, secure, and flexible option for South Africans needing access to personal credit.

With loan amounts up to R25,000, 100% online applications, and quick payouts within 24 hours, it’s a solid solution for those unexpected life moments.

Features like the skip-a-payment option and the 14-day no-risk return make it even more attractive.

If you’re already an approved client or have been invited to apply, FinChoice delivers both convenience and confidence.

Looking for alternatives? Check out Hippo Loans — a comparison platform that helps you find the most competitive personal loan rates from multiple providers in South Africa. It’s perfect if you want to explore different options before deciding.

Recommended Content