Anúncios

Get approved in minutes and repay over up to three months

FASTA Loans is a smart solution for South Africans needing fast, short-term financial assistance. The entire process is online, quick, and transparent from start to finish.

Whether it’s for an unexpected bill or urgent repairs, this loan gives you flexibility, fast payouts, and repayment terms that won’t overload your monthly budget.

Loans

FASTA

| Maximum Loan Amount | R8,000 |

| Repayment Period | Up to 3 months |

| Fees | R534 (initiation), R69/month (service) |

| Credit Insurance | R73.67 |

| Maximum APR | 123% |

FASTA Loans: What you need to know

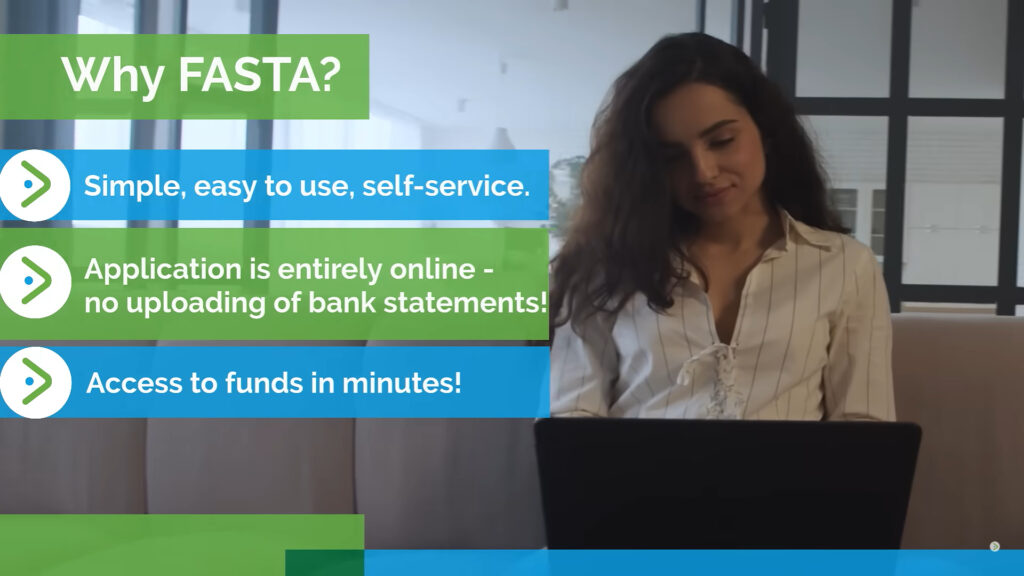

FASTA Loans are designed for those who need a quick financial boost without lengthy paperwork or delays.

Applications are done online using a simple slider to select the loan amount and number of instalments.

Once you submit your application, verification checks are conducted to assess affordability and ensure responsible lending.

If approved, your loan is paid directly into your bank account within minutes.

You can borrow up to R8,000 and repay in one, two, or three monthly instalments depending on your budget.

Loans

FASTA

Who can benefit from this option?

FASTA Loans are best suited for individuals seeking short-term financial relief. It’s not just about who qualifies, but who truly benefits from this type of credit.

- First-time borrowers

Those new to personal loans can use FASTA to build credit and experience a straightforward, digital process. - Salaried professionals

People with regular monthly income can comfortably manage the instalments across the repayment period. - Self-employed individuals

With verifiable income and internet banking, self-employed users can also access fast cash when needed. - Emergency planners

If you like having backup options for emergencies, FASTA can serve as a financial safety net. - Online-savvy users

Those comfortable with digital platforms will enjoy the ease of applying and managing their loan online.

What makes FASTA Loans different?

Not all short-term loans are created equal. FASTA stands out by offering speed, flexibility, and full control to the borrower — all online.

- Fast approval and payout

Once approved, the funds are transferred within minutes to your bank account, helping you act immediately on urgent needs. - Tailored repayment options

You choose how many months you’d like to repay — between one and three — to fit your budget. - No paperwork or long queues

Skip the red tape. Everything happens digitally, saving time and effort. - Transparent fee structure

You’re shown exactly what you’ll pay, including initiation fees, service fees, and credit insurance. - Focus on responsible lending

FASTA runs affordability checks to make sure loans don’t push borrowers into difficult situations.

Can you trust FASTA with your loan?

Yes, FASTA operates under South African credit regulations, and its lending practices are built on transparency and consumer protection.

The company performs affordability assessments before approving any application. This ensures you’re only offered what you can reasonably repay.

All terms, fees, and conditions are displayed clearly during the process, with no hidden costs or misleading fine print.

Borrowers must sign a formal loan agreement before any funds are released, protecting both sides and providing legal clarity.

With encrypted systems and secure banking integration, your personal and financial data remain protected at all times.

FASTA’s commitment to responsible lending and customer safety sets it apart as a reliable financial partner.

Common uses of FASTA Loans in practice

Short-term loans like FASTA aren’t for long-term debt. They work best in very specific situations where time and access are critical.

- Unexpected medical expenses

When a sudden health issue arises, you can access funds fast to pay for checkups, medication, or treatments. - Car repairs

If your car breaks down and you need it for work or family, a FASTA loan can help cover repairs immediately. - School fees or supplies

Back-to-school costs can sneak up on families. A quick loan lets you pay fees or buy uniforms without delay. - Urgent home maintenance

Fixing a burst pipe or replacing a broken appliance isn’t something you can always plan for. - Bridging gap before payday

If something comes up mid-month, this loan can fill the gap until your next salary comes in.

Simple steps to get your FASTA Loan

Getting started with FASTA is simple, and you won’t need to leave your house. With just your ID and online banking, the process is streamlined.

The loan application is built to be quick and mobile-friendly. You’ll know if you’re approved in just a few minutes — no phone calls or back-and-forth emails.

- Choose your loan amount and term

Visit the FASTA website, use the slider to select the amount you need, and choose one to three months for repayment. - Complete the online application

Fill in your personal details, banking info, and income details. Accuracy helps speed up approval. - Submit for verification

FASTA performs a quick check on your affordability and verifies your details against credit databases. - Receive your offer

If everything checks out, you’ll receive a loan offer outlining the terms, fees, and repayment schedule. - Accept and receive your money

Sign the digital loan agreement, and the funds are transferred directly to your bank account — usually within minutes.

Minimum conditions to get approved

To apply for a FASTA Loan, you must meet a few basic but essential requirements.

You need to be a South African citizen or permanent resident with a valid RSA ID number. This is used to verify your identity and check your credit history.

Applicants must be at least 18 years old and legally able to enter into a credit agreement.

It’s also necessary to have access to internet banking, as FASTA uses digital verification processes tied to your bank account.

Lastly, proof of verifiable income over the last 90 days is essential. This helps determine your affordability and ensures the loan won’t put undue pressure on your budget.

If you meet all these criteria, your chances of approval are high, and the process is incredibly fast.

Recommended alternative: Lime Loans

FASTA Loans is a reliable, fast, and flexible solution for short-term borrowing in South Africa. With transparent terms and an easy application, it’s a great fit for many.

However, if you’re looking for other trusted options with similar benefits, it’s worth considering Lime Loans as well.

They also provide short-term lending with a focus on simplicity and speed, making them a solid backup or alternative.

Check out our full guide on Lime Loans to compare features and find the right fit for your financial needs.

Recommended Content