Anúncios

Flexible loan terms and clear fees for quick financial support

Atlas Finance Loans is one of the most accessible short-term credit solutions for South Africans. With loans ranging from R500 to R8,000 and flexible terms, it meets real needs.

Whether you’re dealing with a sudden bill or planning for the month ahead, this loan option gives you speed, control, and financial breathing room in just a few clicks.

Loans

Atlas Finance

| Loan Amount | R500 to R8,000 |

| Repayment Terms | 1 to 6 months |

| Interest Rate | Between 36% and 60% APR |

| Monthly Service Fee | R60 + VAT |

| Initiation Fee | R165 (first R1,000) + 10% of remaining (max R1,050 + VAT) |

| Insurance (Credit Life) | R5.50 per R1,000 borrowed |

Atlas Finance Loans: What you need to know

Atlas Finance Loans are designed to be both fast and practical. You can borrow as little as R500 or up to R8,000 depending on your affordability.

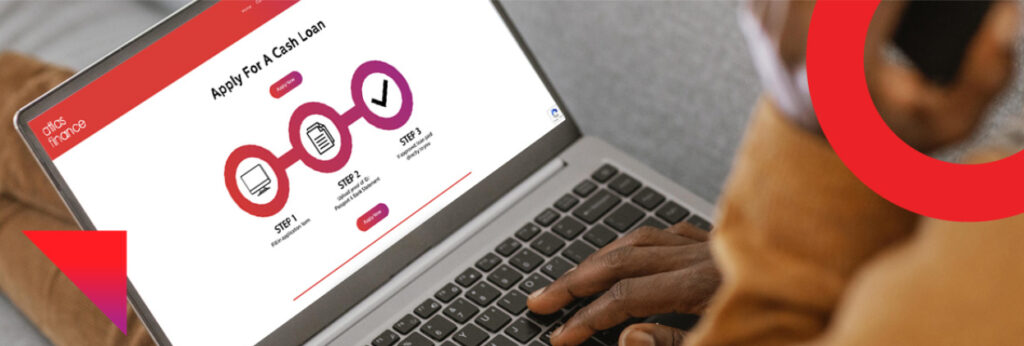

The application process is online and completed in just three simple steps. No queues, no paperwork, and no phone calls required.

Once approved, the money is deposited directly into your account. Repayments are automated through monthly debit orders.

The company offers repayment flexibility from one month up to six months, allowing you to choose what works best.

Clear cost disclosure and no hidden fees make it a transparent and secure loan option for everyday financial needs.

Loans

Atlas Finance

Who can benefit from this option?

Atlas Finance Loans are not for everyone — they work best for individuals facing short-term financial gaps or looking for simple, fast credit access.

- Salaried employees

Those with regular income can benefit from fixed repayment schedules deducted monthly from their bank account. - Emergency borrowers

People dealing with unplanned medical expenses, car repairs, or urgent bills find this option fast and reliable. - First-time loan users

The straightforward application process suits those unfamiliar with formal credit processes. - Short-term planners

Ideal for individuals who prefer not to carry long-term debt and want to repay within a few months. - Credit-challenged users

Atlas considers affordability and not only credit score, opening doors for more applicants.

What makes Atlas Finance Loans different?

Atlas Finance stands out because it blends speed, transparency, and responsibility in a way that few other providers do.

- Quick online application

The entire process is digital and requires no in-person visits or complicated paperwork. - Flexible repayment terms

You choose between 1 to 6 months — perfect for adjusting to your current income and plans. - Transparent cost structure

All fees and interest rates are explained upfront, with no hidden clauses or unexpected charges. - Inclusive approval criteria

Unlike some lenders, Atlas looks beyond your credit score, assessing your true repayment capacity. - Regulated and trustworthy

Fully registered under the National Credit Act, ensuring compliance with responsible lending standards.

Can you trust Atlas Finance with your loan?

Yes, Atlas Finance is a legitimate and responsible lender in South Africa. It operates under the regulations of the National Credit Act (NCA), ensuring fairness and transparency.

The company is a registered credit provider, which means it must follow strict rules regarding interest rates, disclosure of fees, and responsible lending practices.

All information about costs is disclosed before you sign. You’ll know exactly how much you’ll repay and when, avoiding any confusion or last-minute surprises.

Additionally, every loan includes Credit Life Insurance. This means your debt is covered in the event of death, disability, or retrenchment — offering both peace of mind and protection.

Security and compliance are at the heart of Atlas Finance’s operations, making it a trustworthy partner for short-term credit.

Common uses of Atlas Finance Loans in practice

Short-term loans are most useful when you’re managing an urgent or time-sensitive need. Atlas Finance makes it easy to handle these situations confidently.

- Unexpected medical costs

Get the care you need now and settle the payment over time with clear and manageable terms. - Essential home repairs

Fix plumbing, electricity, or broken appliances without dipping into long-term savings. - School-related expenses

Cover school uniforms, books, or registration fees during peak periods without financial stress. - Debt bridging

When payday is still far and you need to avoid bounced payments or additional charges. - Transport issues

Repair your car or get to work on time when public transport fails or funds are short.

Simple steps to get your Atlas Finance Loan

You don’t need to visit a branch or print a single form. Everything from the application to the payout is handled online.

In just a few clicks, you could have the money in your account — securely and without delays.

- Fill out the online application

Visit the Atlas Finance website and complete the digital form with your personal and financial details. - Upload your documents

You’ll need to submit a valid ID or passport, your latest payslip, and your last 3 months of bank statements. - Wait for approval

Your documents will be reviewed, and if everything checks out, you’ll receive a notification within hours. - Receive your funds

Approved? Great — the funds will be sent directly to your bank account, often within 24 to 48 hours. - Start repayments

On your chosen date each month, a debit order will handle your instalment automatically.

Minimum conditions to get approved

To qualify for an Atlas Finance Loan, you must meet a few basic requirements that prove your ability to repay.

You need to be over 18 years old and have a valid South African ID or, if you’re a foreign national, a valid passport and work permit.

Applicants must also be employed and able to provide their latest payslip along with three months’ worth of bank statements.

These documents are essential to assess your income and ensure that the loan amount aligns with your affordability.

Approval is not guaranteed, but if your documents reflect a stable income and manageable expenses, your chances are high.

Atlas also checks your credit profile, but it’s not the only factor considered. What matters most is your repayment ability.

Recommended alternative: Boodle Loans

Atlas Finance Loans offer a reliable solution for urgent financial needs with flexibility and fair terms. But it’s always good to explore alternatives that might suit you even better.

If you’re looking for another short-term loan option with fast payouts and competitive interest, Boodle Loans is worth checking out.

Boodle provides similar loan amounts and is also known for quick online approvals and a user-friendly interface. It’s especially appealing to those who want ultra-short repayment periods.

Interested in comparing? You can check our next article covering Boodle Loans in detail and see which provider fits your financial goals best.

Recommended Content